Stage 2 | Subject outline | version control

Accounting

Stage 2

Subject outline

For teaching in Australian and SACE International schools from January 2024 to December 2024.

For teaching in SACE International schools only from May/June 2023 to March 2024, and from May/June 2024 to March 2025.

Accredited in August 2018 for teaching at Stage 2 from 2020.

Stage 2 | Subject outline | Content

Content

Stage 2 Accounting is a 20-credit subject structured around three focus areas:

- understanding accounting concepts and conventions

- managing financial sustainability

- providing accounting advice.

These focus areas provide real-world opportunities and environments in which students can develop, extend, and apply their skills, knowledge, understanding, and capabilities to study accounting practices in a range of enterprises, including, for example:

- local, national, and multinational enterprises

- small, medium, and large businesses

- public–private partnerships

- primary, secondary, and tertiary enterprises

- online enterprises

- not-for-profit organisations.

Through their study of each of the three focus areas, students develop and apply their understanding of the following underpinning learning strands:

- financial literacy

- stakeholder information and decision-making

- innovation.

These learning strands outline the knowledge, skills, understanding, and capabilities fundamental to the learning in the subject. The strands of financial literacy and stakeholder information and decision-making provide opportunities for students to understand and apply accounting concepts and conventions. The learning strand of innovation is focused on the use of new and emerging technologies to create, store, and communicate accounting information. Technology enables effective connections with business and opens up opportunities to better understand the changing nature of the accounting needs of stakeholders and to better provide advice and recommendations to meet these needs.

The diagram below illustrates the framework for Stage 2 Accounting:

Accounting practice and accounting activities

The practice of accounting is the process of identifying, measuring, and communicating economic information to facilitate informed decision-making for the stakeholders, as well as to enable control and discharge of accountability by management.

Accounting activities are the actions taken within this process.

Accounting concepts and conventions

The following concepts and conventions underpin all accounting focus areas and inform the practice of accounting studied at Stage 2:

- accrual accounting

- accounting entity

- accounting period

- consistency

- duality

- going concern

- monetary unit

- legal entity

- historical cost

- materiality

- prudence

- realisation

- relevance

- faithful representation.

These concepts and conventions are drawn from the Framework for the Preparation and Presentation of Financial Statements prepared by the Australian Accounting Standards Board.

Accounting reports

|

|

|

|---|---|

| Income statement The measurement of profit or loss |

|

| Balance sheet Statement of financial position |

|

| Statement of changes in equity |

|

| Statement of cash flows Sources of cash inflows and outflows |

|

Links between accounting reports

|

|

|

|---|---|

| Income statement and statement of changes in equity | Calculation of profit |

| Income statement and balance sheet | Impact of profit on the entity’s equity position |

| Income statement and statement of cash flows | Cash versus accrual representation of periodic flows (especially from operations) |

| Balance sheet and statement of changes in equity | End of period equity position of the entity |

| Balance sheet and statement of cash flows | Flow analysis of change in cash position over a period |

Analysis tools

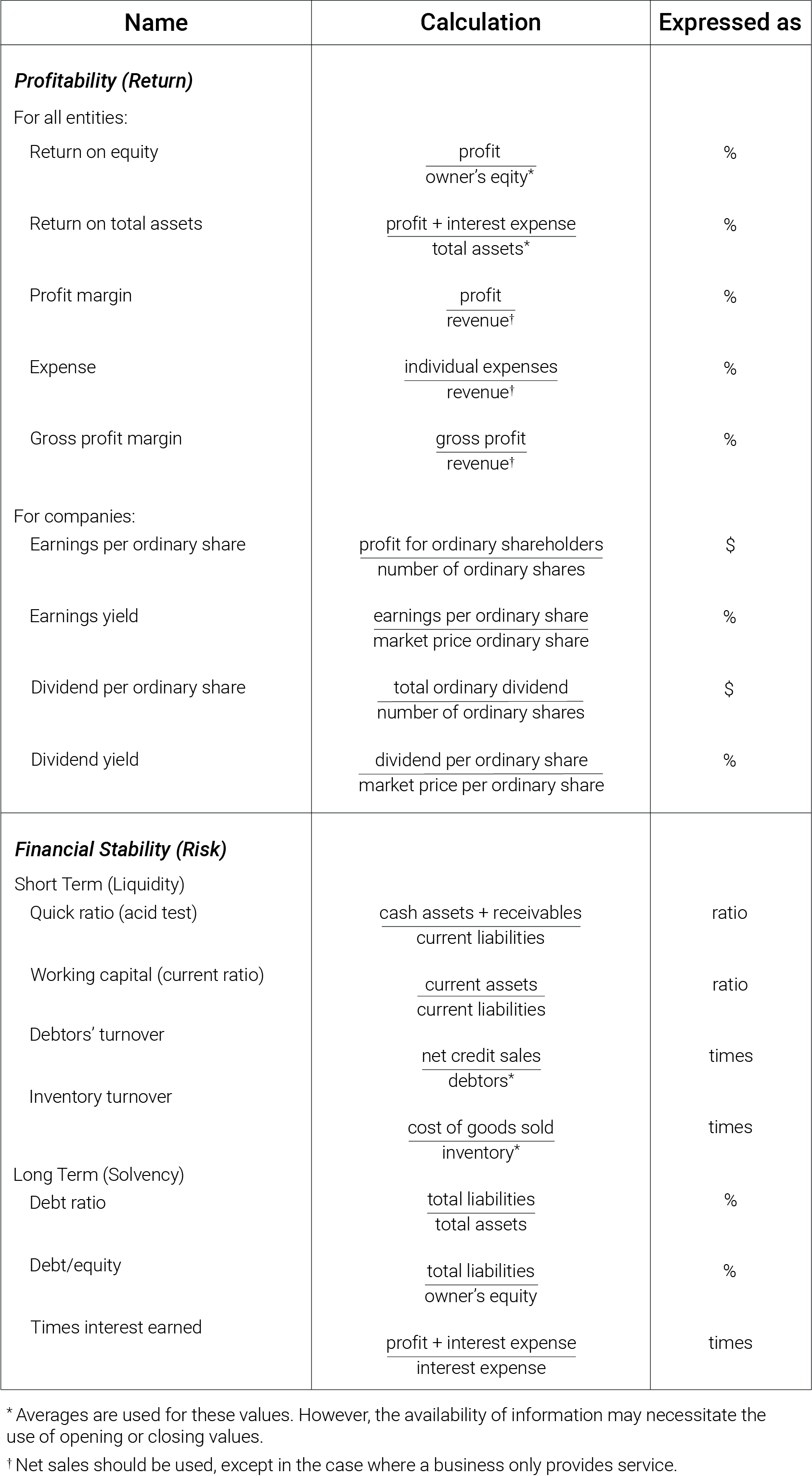

Students may use the following ratios for analysis of financial information:

TEST - table

Analysis tools

Students may use the following ratios for analysis of financial information:

|

|

|

Expressed as |

|---|---|---|

|

Profitability (Return) For all entities: Return on equity Return on total assets Profit margin Expense Gross profit margin For all entities: Earnings per ordinary share Earnings yield Dividend per ordinary share Dividend yield |

Return on equity Return on total assets Profit margin Expense Gross profit margin

Earnings per ordinary share Earnings yield Dividend per ordinary share Dividend yield |

% % % % %

$ % $ % |

| Balance sheet Statement of financial position |

|

|

| Statement of changes in equity |

|

|

| Statement of cash flows Sources of cash inflows and outflows |

|