Stage 2 | Subject outline | version control

Accounting

Stage 2

Subject outline

For teaching in Australian and SACE International schools from January 2024 to December 2024.

For teaching in SACE International schools only from May/June 2023 to March 2024, and from May/June 2024 to March 2025.

Accredited in August 2018 for teaching at Stage 2 from 2020.

Stage 2 | Green Banner

Stage 2 | Subject outline | Subject description

Subject description

Accounting is a 20-credit subject at Stage 2.

Accounting is the language of business and is used to tell the financial story of an entity. Accounting helps business owners to understand their business so that they can make informed decisions. The practice of accounting is used to record, report, analyse, and communicate past events, current activities, and potential challenges and opportunities.

In Stage 2 Accounting, students develop and extend their understanding of the underpinning accounting concepts and conventions used to understand and classify financial transactions within a business. Through the learning in the focus area of managing financial sustainability, students develop and apply their knowledge of accounting processes to prepare and report accounting information to meet stakeholder needs. Students transfer this knowledge to scenarios and consider the influence of local and global perspectives on accounting practices.

Students analyse and evaluate accounting information to develop and propose authentic accounting advice to inform the decision-making of a variety of stakeholders. Students develop critical thinking and problem-solving skills to devise accounting solutions and apply communication skills in authentic accounting contexts.

Students examine current and emerging social trends, evolving technologies, government regulations, environmental issues, new markets, and other economic factors, as well as ethics and values, when exploring the practice of accounting. Students explore the impact accounting has had on society and possible future opportunities involving accounting.

Web Content Display (Global)

Capabilities

The capabilities connect student learning within and across subjects in a range of contexts.

The SACE identifies seven capabilities.

Stage 2 | Subject outline | Capabilities | Literacy

Literacy

In this subject students extend and apply their literacy capability by, for example:

- extending their understanding of and applying appropriate accounting terminology

- collecting and creating non-financial information

- critically analysing and evaluating accounting information

- communicating financial and non-financial information

- communicating appropriately for specific purposes and stakeholders

- reporting accounting information to a variety of stakeholders to manage financial sustainability

- identifying and analysing problems and proposing accounting advice to inform decision-making.

Stage 2 | Subject outline | Capabilities | Numeracy

Numeracy

In this subject students extend and apply their numeracy capability by, for example:

- collecting, processing, and creating financial information

- preparing financial reports and advice using appropriate accounting concepts and conventions

- calculating ratios to analyse business performance

- using financial information to forecast outcomes and provide advice to inform decision-making.

Stage 2 | Subject outline | Capabilities | Information and communication technology (ICT) capability

Information and communication technology (ICT) capability

In this subject students extend and apply their (ICT) capability by, for example:

- locating and accessing financial and non-financial information using digital technologies

- using a range of digital technologies to extract, interpret, and analyse financial and non-financial information

- using digital technologies to communicate accounting information in contemporary ways to meet the needs of stakeholders

- using digital technologies to work collaboratively in local and/or global contexts

- understanding the role and application of digital technologies in the collection, management, and analysis of financial information and the production of accounting reports and advice to inform decision-making.

Stage 2 | Subject outline | Capabilities | Critical and creative thinking

Critical and creative thinking

In this subject students extend and apply their critical and creative thinking capability by, for example:

- exploring and explaining accounting concepts and conventions, considering local and global perspectives

- applying accounting concepts and conventions to analyse and evaluate financial and non-financial information to make forecasts and provide advice to stakeholders to inform decision-making

- evaluating the reliability of financial and non-financial information for accurate decision-making in an accounting context

- creating accounting information for a range of stakeholders

- analysing and evaluating financial and non-financial information to identify issues and/or trends to propose financial solutions

- considering the evolving role of accounting in society.

Stage 2 | Subject outline | Capabilities | Personal and social capability

Personal and social capability

In this subject students extend and apply their personal and social capability by, for example:

- collaborating with others to create and/or provide authentic accounting advice

- communicating with stakeholders to provide accounting advice to inform decision-making

- developing an understanding of how accounting applies to their personal circumstances.

Stage 2 | Subject outline | Capabilities | Ethical understanding

Ethical understanding

In this subject students extend and apply their ethical understanding capability by, for example:

- considering the ethical implications of accounting activities on individuals, groups, and/or society now and in the future

- considering and applying ethical strategies for collaborating with others

- evaluating the ethical issues surrounding the collection, storage, and creation of financial and non-financial information

- understanding the appropriate and ethical application of financial and non-financial information, taking local and global perspectives into consideration

- exploring the impact of ethics and values in the development of authentic accounting advice for decision-making.

Stage 2 | Subject outline | Capabilities | Intercultural understanding

Intercultural understanding

In this subject students extend and apply their intercultural understanding capability by, for example:

- developing an understanding of accounting in various cultural contexts

- respecting and engaging with different cultural views and customs in an accounting context

- understanding that financial sustainability and the provision of accounting advice is influenced by local and global perspectives

- exploring accounting-related issues in local, national, and global contexts to provide advice for a diverse range of stakeholders

- recognising that engaging with different cultural perspectives enhances one’s own knowledge and understanding.

Web Content Display (Global)

Aboriginal and Torres Strait Islander knowledge, cultures, and perspectives

In partnership with Aboriginal and Torres Strait Islander communities, and schools and school sectors, the SACE Board of South Australia supports the development of high-quality learning and assessment design that respects the diverse knowledge, cultures, and perspectives of Indigenous Australians.

The SACE Board encourages teachers to include Aboriginal and Torres Strait Islander knowledge and perspectives in the design, delivery, and assessment of teaching and learning programs by:

- providing opportunities in SACE subjects for students to learn about Aboriginal and Torres Strait Islander histories, cultures, and contemporary experiences

- recognising and respecting the significant contribution of Aboriginal and Torres Strait Islander peoples to Australian society

- drawing students’ attention to the value of Aboriginal and Torres Strait Islander knowledge and perspectives from the past and the present

- promoting the use of culturally appropriate protocols when engaging with and learning from Aboriginal and Torres Strait Islander peoples and communities.

Stage 2 | Subject outline | Learning requirements

Learning requirements

The learning requirements summarise the knowledge, skills, and understanding that students are expected to develop and demonstrate through their learning in Stage 2 Accounting.

In this subject, students are expected to:

- understand and explore accounting concepts and conventions

- apply accounting concepts and conventions to create accounting information

- explore and interpret stakeholder needs to inform accounting information requirements

- analyse and evaluate accounting information to manage financial sustainability

- analyse and evaluate accounting information to develop and propose authentic accounting advice to inform decision-making

- apply communication skills in an accounting context.

Stage 2 | Subject outline | Content

Content

Stage 2 Accounting is a 20-credit subject structured around three focus areas:

- understanding accounting concepts and conventions

- managing financial sustainability

- providing accounting advice.

These focus areas provide real-world opportunities and environments in which students can develop, extend, and apply their skills, knowledge, understanding, and capabilities to study accounting practices in a range of enterprises, including, for example:

- local, national, and multinational enterprises

- small, medium, and large businesses

- public–private partnerships

- primary, secondary, and tertiary enterprises

- online enterprises

- not-for-profit organisations.

Through their study of each of the three focus areas, students develop and apply their understanding of the following underpinning learning strands:

- financial literacy

- stakeholder information and decision-making

- innovation.

These learning strands outline the knowledge, skills, understanding, and capabilities fundamental to the learning in the subject. The strands of financial literacy and stakeholder information and decision-making provide opportunities for students to understand and apply accounting concepts and conventions. The learning strand of innovation is focused on the use of new and emerging technologies to create, store, and communicate accounting information. Technology enables effective connections with business and opens up opportunities to better understand the changing nature of the accounting needs of stakeholders and to better provide advice and recommendations to meet these needs.

The diagram below illustrates the framework for Stage 2 Accounting:

Accounting practice and accounting activities

The practice of accounting is the process of identifying, measuring, and communicating economic information to facilitate informed decision-making for the stakeholders, as well as to enable control and discharge of accountability by management.

Accounting activities are the actions taken within this process.

Accounting concepts and conventions

The following concepts and conventions underpin all accounting focus areas and inform the practice of accounting studied at Stage 2:

- accrual accounting

- accounting entity

- accounting period

- consistency

- duality

- going concern

- monetary unit

- legal entity

- historical cost

- materiality

- prudence

- realisation

- relevance

- faithful representation.

These concepts and conventions are drawn from the Framework for the Preparation and Presentation of Financial Statements prepared by the Australian Accounting Standards Board.

Accounting reports

|

|

|

|---|---|

| Income statement The measurement of profit or loss |

|

| Balance sheet Statement of financial position |

|

| Statement of changes in equity |

|

| Statement of cash flows Sources of cash inflows and outflows |

|

Links between accounting reports

|

|

|

|---|---|

| Income statement and statement of changes in equity | Calculation of profit |

| Income statement and balance sheet | Impact of profit on the entity’s equity position |

| Income statement and statement of cash flows | Cash versus accrual representation of periodic flows (especially from operations) |

| Balance sheet and statement of changes in equity | End of period equity position of the entity |

| Balance sheet and statement of cash flows | Flow analysis of change in cash position over a period |

Analysis tools

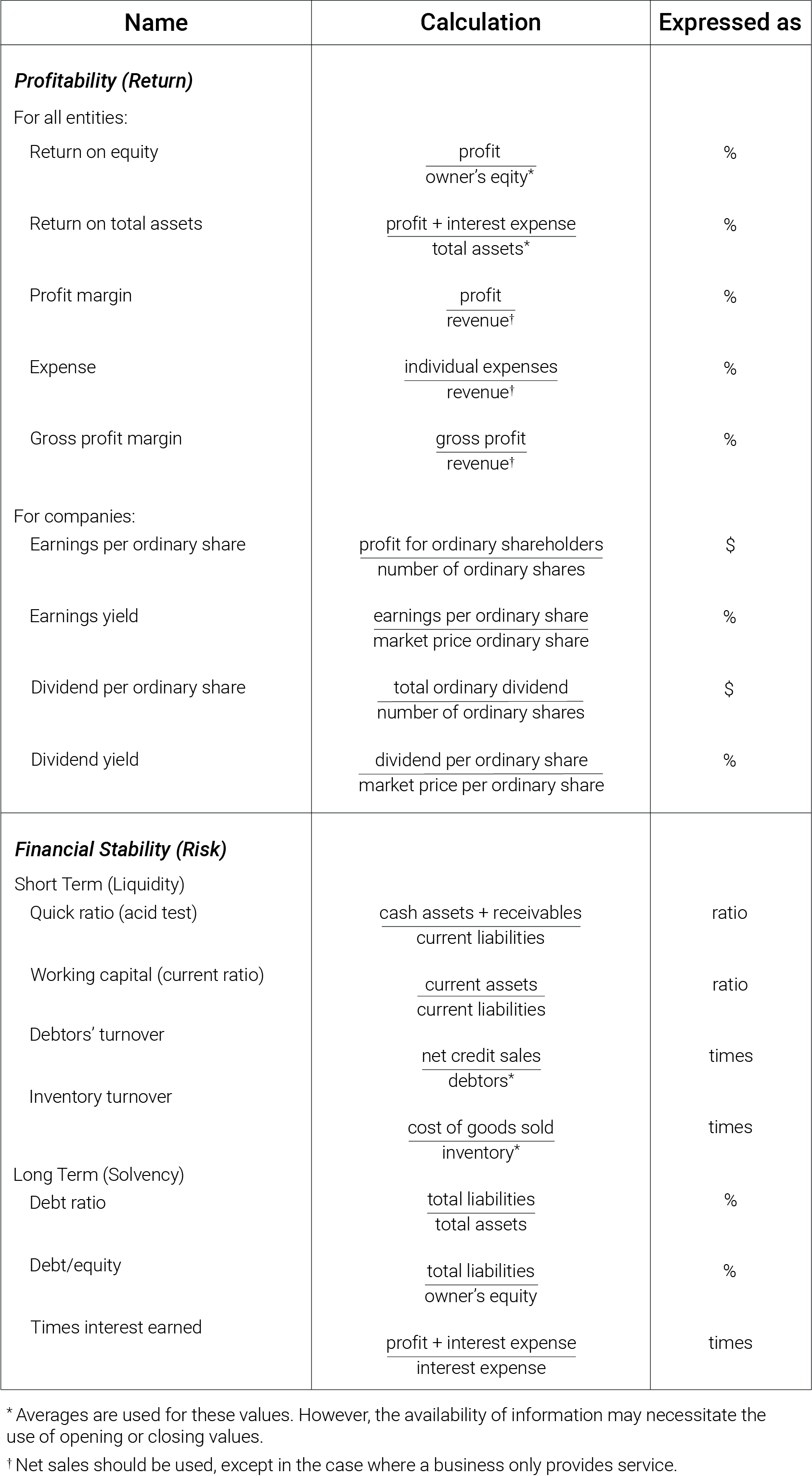

Students may use the following ratios for analysis of financial information:

Stage 2 | Subject outline | Content | understanding-accounting-concepts-and-conventions

Understanding accounting concepts and conventions

Accounting concepts and conventions underpin accounting practice.

In the focus area of understanding accounting concepts and conventions, students develop the foundational understanding of accounting and explore how accounting concepts and conventions impact accounting activities. They examine emerging accounting and business trends and opportunities, taking into account local and global perspectives. Students develop and extend their understanding of the existence and influence of regulatory frameworks on accounting activities.

Financial literacy

Students develop an understanding of the functions and main features of a range of entities. They distinguish between the accounting entity and the legal entity in a range of structures.

Students understand, apply, and explain the accounting process, the accounting equation, and the principles of a double-entry recording process (the duality concept). They understand and explore the various elements of accounting reports, as well as the role of qualitative and quantitative information. Students understand and apply the faithful representation, relevance, consistency, and materiality of that information.

Students understand and apply the terminology and features of a range of reports used by different entities to communicate accounting information. They explore:

- how financial transactions impact on the accounting information within reports

- the links between reports

- the effects of accrual accounting, historical cost, and prudence

- the implications of the accounting period on the preparation of final reports.

Stakeholder information and decision-making

Students consider the users of accounting information and explore the reporting needs of a range of accounting entities. They analyse the impact of the legal entity concept on reports and stakeholder information needs.

Students examine the interrelationship of accounting concepts and conventions in preparing information to achieve the accountability, control, and decision-making functions of accounting.

Students understand that accounting information is the result of the accounting process; that it has a purpose, and that it is used by stakeholders to inform decision-making.

Innovation

Students develop and extend their understanding of the changing uses and forms of accounting information in the context of the evolving needs of a range of stakeholders. They focus on emerging trends and opportunities in accounting and business.

Students examine the impact of digital technologies* on:

- accounting activities

- the creation of and access to accounting information.

Students explore innovative methods of communicating accounting information to meet specific needs of stakeholders.

*There is no requirement for students to use accounting software to examine, create, and access accounting information.

Stage 2 | Subject outline | Content | managing-financial-sustainability

Managing financial sustainability

In the focus area of managing financial sustainability, students apply their understanding of accounting concepts and conventions to produce accounting information that takes into consideration local and global perspectives to meet the needs of a variety of stakeholders. Students analyse and interpret qualitative and quantitative information to manage financial sustainability for a range of enterprises.

Financial literacy

Students understand the purpose and procedures for controlling assets and liabilities. Using prudence in valuation, as well as accounting concepts of historical cost, consistency, and faithful representation, students record accounting information related to:

- cash, including:

- receipts and payments.

- inventory, including:

- the preparation of perpetual inventory records using inventory cards and ledgers (first-in first-out and specific identification methods).

- stock adjustments on the inventory card, in the general journal, and in the inventory control account. Through stock adjustments, students develop their understanding of the role of a stocktake.

- debtors, including:

- preparation of debtors’ ledger, control account, and schedule of debtors. The preparation of specialised journals is not required.

- bad debt write-off and creation of an allowance for doubtful debts. Through the recording of bad and doubtful debts, students develop their understanding of the distinction between bad and doubtful debts and their importance when creating financial reports.

- non-current assets, including:

- depreciation using the various methods of straight-line, diminishing-balance, and units-of-use. Through the recording of depreciation in the general journal and ledger, students develop their understanding of the need to account for depreciation.

Students recognise and interpret reports of different accounting entities but generate reports only for a sole trader. In preparing reports, students apply their understanding of the difference between profit and cash flow (including accrual accounting concepts) for financial sustainability and business management.

Using the concepts of materiality and accrual accounting, students prepare balance-day adjustments in the general journal to create adjusted account balances to produce classified final reports. They interpret this information to evaluate business performance.

Students prepare budgeted final reports, including cash budgets. They use this information to forecast business performance.

In preparing bank reconciliation statements, students extend their understanding of the importance of the control of assets and liabilities through the reconciliation of cash records with the bank statement.

Students analyse business performance by calculating appropriate ratios to measure return and risk, including the calculation and analysis of inventory turnover, debtor turnover, and the debt ratio.

When using financial information for accountability, control, and decision-making, students identify the limitations inherent in the accounting concepts and conventions, such as in the use of:

- monetary unit

- historical cost

- consistency

- prudence

- the accounting period.

Stakeholder information and decision-making

Within the practice of accounting, students analyse the existing and emerging social, legal, economic, technological, environmental, and/or ethical considerations that affect or are affected by decision-making.

Students understand the purpose of accounting reports to manage financial sustainability. They use qualitative and quantitative information to evaluate financial sustainability.

Students understand the need for procedures to control assets by exploring the importance of monitoring the amounts, turnover, and storage and security of inventory. Students also recognise the importance of credit-control procedures including screening debtors, determining credit limits, providing discounts, and charging interest.

Students apply their understanding of the impact of various sources of information on stakeholder decision-making by applying the ‘lower of cost or net realisable value’ rule to inventory and through the interpretation of a debtors’ ageing analysis.

Students analyse and interpret final and budgeted financial statements, including breakeven analysis. They comment on the implications of this accounting information for financial sustainability and business decisions.

Students explore types and sources of finance and develop their understanding of the differences between external and internal sources of funds and the associated costs, benefits, and risks. They consider the implications of those sources of finance for an enterprise and its stakeholders.

Students understand the suitability of various depreciation methods for different types of assets in order to produce materially accurate information for stakeholder decision-making.

Innovation

Students evaluate the use of digital and emerging technologies to manage financial sustainability, such as, but not limited to:

- the real-time availability of financial information facilitated by cloud-based and webbased accounting systems

- the changing nature of a stakeholder’s requirements for the preparation, interpretation, and analysis of financial information, such as:

- the (decreasing) reliance on accounting professionals for the preparation of accounting information

- the (increasing) requirement for the interpretation and analysis of accounting information

- advice from accounting professionals on the set-up, use, and maintenance of digital accounting systems.

- the ability to manage financial sustainability remotely and in real time

- the timeliness and nature of communication with accounting professionals.

Students consider the impact of internal and external influences when evaluating the accounting information needs of stakeholders, such as, but not limited to:

- domestic and global interest rates

- business objectives

- political influences.

Students create financial information to meet these needs.

Stage 2 | Subject outline | Content | providing-accounting-advice

Providing accounting advice

In the focus area of providing accounting advice, students evaluate accounting information to develop and propose authentic accounting advice for a variety of stakeholders. They analyse financial and non-financial information, taking into consideration local and global perspectives to inform accounting advice. They evaluate this information when providing advice to stakeholders. Students have the opportunity to work collaboratively in the evaluation of accounting information, and in their development of authentic accounting advice. The flexible nature of this collaboration may lead students to collaborate with each other and/or with key external stakeholders.

Financial literacy

Students analyse and interpret financial and non-financial information, for example, but not limited to:

- classified final reports

- budgeted reports

- ratios

- other accounting information tailored to stakeholder needs.

Students comment on the inherent limitations of this information. They provide authentic accounting advice with options and recommendations to meet stakeholder needs.

Stakeholder information and decision-making

Students apply their understanding that decision-making is a process which can be impacted by existing and emerging social, legal, economic, technological, environmental, and/or ethical considerations.

Students provide advice to stakeholders on the suitability of different business ownership structures, referring to both financial and non-financial information.

Students provide advice to stakeholders on the suitability of potential sources of finance for short-term and long-term business success.

Students analyse financial and non-financial information to develop a forecast of possible business outcomes. They provide accounting advice to stakeholders with options and recommendations.

Innovation

In developing authentic accounting advice to meet stakeholder needs, students consider local and global influences as they explore and analyse the impact of:

- current and emerging social trends

- government regulations

- new markets and other economic factors

- evolving technologies

- environmental issues

- ethics and values.

Stage 2 | Subject outline | Evidence of learning

Evidence of learning

All Stage 2 subjects have a school assessment component and an external assessment component.

The following assessment types enable students to demonstrate their learning in Stage 2 Accounting.

School Assessment (70%)

- Assessment Type 1: Accounting Concepts and Solutions (40%)

- Assessment Type 2: Accounting Advice (30%)

External Assessment (30%)

- Assessment Type 3: Examination (30%).

Students provide evidence of their learning through six assessments, including the external assessment component. Students undertake:

- four accounting concepts and solutions tasks

- one accounting advice

- one examination.

Stage 2 | Subject outline | Assessment design criteria

Assessment design criteria

The assessment design criteria are based on the learning requirements and are used by:

- teachers to clarify for the student what he or she needs to learn

- teachers and assessors to design opportunities for the student to provide evidence of his or her learning at the highest possible level of achievement.

The assessment design criteria consist of specific features that:

- students should demonstrate in their learning

- teachers and assessors look for as evidence that students have met the learning requirements.

For this subject the assessment design criteria are:

- understanding and exploration

- application

- analysis and evaluation.

The specific features of these criteria are described below.

The set of assessments, as a whole, must give students opportunities to demonstrate each of the specific features by the completion of study of the subject.

Understanding and Exploration

The specific features are as follows:

| UE1 | Understanding and exploration of accounting concepts and conventions. |

| UE2 | Exploration and interpretation of accounting information needs of stakeholders. |

Application

The specific features are as follows:

| Ap1 | Application of accounting concepts and conventions to create accounting information for stakeholders. |

| Ap2 | Application of communication skills in an accounting context. |

Analysis and Evaluation

The specific features are as follows:

| AE1 | Analysis and evaluation of accounting information to manage financial sustainability. |

| AE2 | Analysis and evaluation of accounting information to develop and propose accounting advice to inform stakeholder decision-making. |

Stage 2 | Subject outline | School assessment

School assessment

The school assessment component for Stage 2 Accounting consists of two assessment types:

- Assessment Type 1: Accounting Concepts and Solutions

- Assessment Type 2: Accounting Advice.

Stage 2 | Subject outline | School assessment | Assessment Type 1: Accounting Concepts and Solutions

Assessment Type 1: Accounting Concepts and Solutions (40%)

Students undertake four accounting concepts and solutions tasks. As a set, these tasks enable students to demonstrate their learning across all three learning strands.

Each of the accounting concepts and solutions tasks may concentrate on one or more learning strands within one focus area or a combination of the focus areas.

Across the set of four tasks, students apply their understanding of accounting concepts and conventions to:

- create and communicate accounting information

- explore, analyse, and interpret stakeholder needs

- analyse and evaluate accounting information

- develop and propose authentic accounting advice.

Scenarios for accounting concepts and solution tasks may include, for example:

- the interpretation of provided or student-sourced relevant accounting information to calculate appropriate ratios. Students complete a ratio analysis to provide advice to the manager of a business, such as the school canteen, to determine, for example, inventory turnover.

- analysis of the revenue and expenses for a local business, such as a local sports club, to produce an income statement and cash flow statement, as well as appropriate advice to help the club president determine the appropriate source of finance to obtain new equipment.

- examination of a business’ decision to manufacture its product offshore. Students evaluate the decision from the perspective of internal and/or external stakeholders. They analyse financial and non-financial information and evaluate issues that may arise from the decision.

- an interview with an accountant or business manager/owner about the key information used for decision-making by the business. Students analyse how and why the business uses the information. They evaluate the use and role of digital and emerging technologies in how the information is recorded, produced, and communicated.

- preparation of appropriate accounting information and advice to help manage the accounts receivable for a local business, such as a plumber. Students prepare a video explaining and supporting their advice for the stakeholder.

Possible formats for accounting concepts and solutions tasks may include, but are not limited to:

- ratio analysis

- preparation of accounts

- oral presentation

- multimodal presentation

- debate

- podcast

- web page

- essay.

Accounting concepts and solutions tasks may be presented in multimodal, oral, or written form. As a set, the tasks comprise a maximum of 3600 words, if written, or the equivalent in oral or multimodal form, where 6 minutes is equivalent to 1000 words. This is inclusive of all financial statements.

For this assessment type, students provide evidence of their learning in relation to the following assessment design criteria:

- understanding and exploration

- application

- analysis and evaluation.

Stage 2 | Subject outline | School assessment | assessment-type-2 Accounting Advice

Assessment Type 2: Accounting Advice

Students develop their accounting advice to suit one of the following focus areas:

- managing financial sustainability

- providing accounting advice.

They demonstrate their learning across all three learning strands.

Students develop accounting information for use by stakeholders in decision-making. Students prepare authentic accounting advice, using business data to:

- prepare forecasts (e.g. budgeted income statement, budgeted balance sheet, budgeted cash flow statement, and any other relevant accounting information)

- analyse and interpret accounting information, such as undertaking break-even analysis, calculating and interpreting ratios, and analysing relevant industry benchmarks

- provide recommendations such as, but not limited to, ownership structure, finance options, location of business, and financial viability of the proposal.

Business data should be realistic and be sourced or created by the teacher and/or student. Some examples include:

- current and historical product prices

- rent, utilities, website domain costs, wages

- interest rates, equipment costs, leasing costs.

Small business benchmarks are available via the Australian Taxation Office (ATO) website. Other sources of current data that may be relevant include:

- Australian Bureau of Statistics (ABS)

- business or industry associations.

For this assessment type, students analyse and evaluate a business opportunity or address a business issue to propose authentic accounting advice. Accounting advice scenarios may include, for example:

- developing a profitability analysis in response to a business opportunity. For example, a local farmer is considering changing the crops she grows. Students use authentic data, including current and historical prices to develop and propose advice to the farmer on crop selection to inform decision-making. They contact relevant stakeholders to obtain appropriate information for use in the development of authentic accounting advice. Students explore and analyse the impact of the decision on the environment, as well as the impacts of government regulations.

- providing accounting advice to a business considering a change in its business model. For example, students review bricks-and-mortar options versus online expansion and prepare comparative budgets to present to the business manager. Students interview the business manager to obtain relevant data. They explore and analyse the impact of new markets and evolving technologies on the expansion options to tailor the advice to meet the needs of the stakeholders and their decision-making requirements.

- developing budgeted reports to determine the viability of a new business venture. For example, students calculate start-up costs and the break-even point for a new cafe. They provide advice to the cafe owner on sources of finance and suitable ownership structures to inform decision-making. Students use appropriate ratio analysis and other accounting information tailored to the owner’s needs to support their advice. They explore and analyse the impact of current and emerging social trends and government regulations.

The accounting advice could be presented in multimodal format to the equivalent of 9 minutes or 1500 words maximum, including all financial statements.

For this assessment type, students provide evidence of their learning primarily in relation to the following assessment design criteria:

- understanding and exploration

- application

- analysis and evaluation.

Stage 2 | Subject outline | External assessment

External assessment

The external assessment component for Stage 2 Accounting consists of an examination.

Stage 2 | Subject outline | External assessment | assessment-type-3-examination

Assessment Type 3: Examination (30%)

Students undertake a 130-minute external examination that is divided into two sections:

- Section 1: Application of accounting skills

- Section 2: Accounting for decision-making.

Section 1: Application of accounting skills

Students answer a range of problem-based or scenario-based questions, integrating accounting knowledge, skills, application, analysis, and interpretation involved in accounting practice.

Questions are drawn from the focus areas of understanding accounting concepts and conventions, and managing financial sustainability. The following specific features of the assessment design criteria may be assessed in this section of the examination:

- understanding and exploration — UE1, UE2

- application — Ap1

- analysis and evaluation — AE1.

Section 2: Accounting for decision-making

Students evaluate and respond to a business issue through the analysis of source material. They analyse, evaluate, and synthesise information to provide accounting advice, considering different stakeholder perspectives. Advice may be provided in dotpoint form.

Content is based on the focus area of providing accounting advice. The following specific features of the assessment design criteria for this subject may be assessed in the examination:

- understanding and exploration — UE2

- application — Ap2

- analysis and evaluation — AE2.

Web Content Display (Global)

Performance standards

The performance standards describe five levels of achievement, A to E.

Each level of achievement describes the knowledge, skills, and understanding that teachers and assessors refer to in deciding how well students have demonstrated their learning on the basis of the evidence provided.

During the teaching and learning program the teacher gives students feedback on their learning, with reference to the performance standards.

At the student’s completion of study of each school assessment type, the teacher makes a decision about the quality of the student’s learning by:

- referring to the performance standards

- assigning a grade between A+ and E– for the assessment type.

The student’s school assessment and external assessment are combined for a final result, which is reported as a grade between A+ and E–.

Stage 2 | Subject outline | Performance standards

Performance standards

Stage 2 performance standards for Accounting can be viewed below. You can also download in Word format [DOC 256KB].

To learn more about what performance standards are, how they are used, and other general information, see performance standards and grades.

| Understanding and Exploration | Application | Analysis and Evaluation | |

|---|---|---|---|

|

A |

In-depth understanding and exploration of accounting concepts and conventions. |

Thorough and logical application of accounting concepts and conventions to create highly relevant accounting information for stakeholders. |

Critical analysis and evaluation of accounting information to manage financial sustainability. |

|

B |

Detailed understanding and exploration of accounting concepts and conventions. |

Mostly thorough and well-informed application of accounting concepts and conventions to create relevant accounting information for stakeholders. |

Mostly critical analysis and evaluation of accounting information to manage financial sustainability. |

|

C |

Competent understanding and exploration of accounting concepts and conventions. |

Considered application of accounting concepts and conventions to create accounting information for stakeholders. |

Some critical analysis and evaluation of accounting information to manage financial sustainability. |

|

D |

Some recognition and basic exploration of accounting concepts and conventions. |

Inconsistent application of accounting concepts and conventions to create accounting information.

|

Description with some explanation of accounting information to manage financial sustainability. |

|

E |

Basic recognition of accounting concepts and conventions. |

Limited application of accounting concepts and conventions to create basic accounting information. |

Attempted description and explanation of accounting information to manage financial sustainability. |

Stage 2 | Subject outline | Subject Changes

Subject changes

Assessment Type 3: Examination

Remove the words 'approximately 50%' from Section 1: Application of accounting skills, and from Section 2: Accounting for decision-making.